Mobilizing Industry Insights forApplication of AI in BFSI

A NASSCOM CoE initiative

There was a time in India when going to the bank meant spending at least half a day in a long queue, waiting endlessly for a user’s financial details to be updated in paper passbooks and ledgers. The bank of today is completely different – its digitized, fast and also, smart. Smart is a simpler way of denoting the extremely intuitive and efficient manner in which banks are processing huge amounts of user data. Banks are now providing smart chatbots, personalized services, preventive maintenance, fraud detection and more, to enhance customer experience and improve operational efficiency.

Increasingly, the use of AI and ML to various functions within banking and financial services (BFSI) has revolutionised the industry in India.

According to data provided by NITI Aayog and Accenture, AI can boost corporate profits by 38% by 2035, potentially adding $1 trillion to the economy. Specifically, AI is expected to have far-reaching impact on the financial services industry on traditional cost bases:

- Banking Industry will witness a $450bn impact by AI

- Investment Management will witness $200bn in AI impact

- Insurance Industry will see a $400bn impact thanks to AI

In order to affect change within the industry and catalyse a difference in approaching business challenges, new solutions need to be more economically impactful than the current traditional cost base.

Over the past 7-8 years, there has been an immense amount of traction in the Indian fintech industry. Fintechs such as Paytm and Mobikwik brought to India the first wave of innovation by providing mobile wallets and payment options. Slowly, there has been an infusion of fintechs dabbling in provision of financial services such as credit to SMEs, insurance, remittance and accounting. A billion-strong population has enabled the stupendous growth of these fintechs, and VC confidence is testimony to the same. In 2012, VC funding in fintechs stood at $22mn while in 2015, the number rose to $1580mn – the highest to date. At 29%, India offers the highest rate of return on fintech projects compared to the global average of 20%.

But now, the time has come to take this burgeoning industry to the next level by leveraging the power of technologies like Artificial Intelligence & Machine Learning. While the innovation in the BFSI industry right now is largely restricted to chatbots, experts believe that this is just the “tip of the iceberg” – and a whole new world of innovation awaits the new-age customer. AI and ML applications can be used to aid decisions on transactions, wealth management, insurance policies, review & monitor financial fraud and so much more.

In light of accelerating innovation in BFSI, NASSCOM CoE has formed a Strategy Innovation Group (SIG) and first roundtable meeting with thought leaders in the BFSI industry was held on 5th March 2019, where the goal was to mobilize traction in the industry to take innovation to the next level.

Highlights of the BFSI-SIG:

- Mobilize AI and Fintech Startups

Common observations around the group concluded that while innovation is definitely on the upswing with financial startups in India, there needs to be consistency and quality to match up to existing enterprise standards. The reach of India’s BFSI cannot be overlooked, and it would bode well for startups to work with enterprises in a more integrated manner to affect change in a horizontal and vertical manner. The added expertise, wealth of experience and industry connections that enterprises have can massively be leveraged by startups, which are spearheading innovation.

- Bridge the Gap Between Problems & Solutions

A pertinent observation made by some members of the group was that startups were creating more problem statements to solve, rather than analysing how to provide solutions to existing challenges in the financial sector. The need of the hour is domain-specific, horizontal innovation. In this aspect, NASSCOM CoE can act as a conduit between enterprises and startups to create a repository of existing challenges within the enterprises, and roping in the most appropriate startups to address these challenges.

- Data Management Critical In FS

Without data, innovation in AI will not happen. However, the rules of data management in India still need to be chalked out properly. With regulatory approvals being put in place in light of growing cyber-crime and financial fraud, having systematic checks and standards in financial data management is critical. With inputs from a cross-section of BFSI industry bodies and decision-makers at the government level, there can be a regulatory data management framework in place for enterprises and startups looking to innovate in this space. NASSCOM CoE can tap into its existing networks and expertise to mobilize data management standards and protocols.

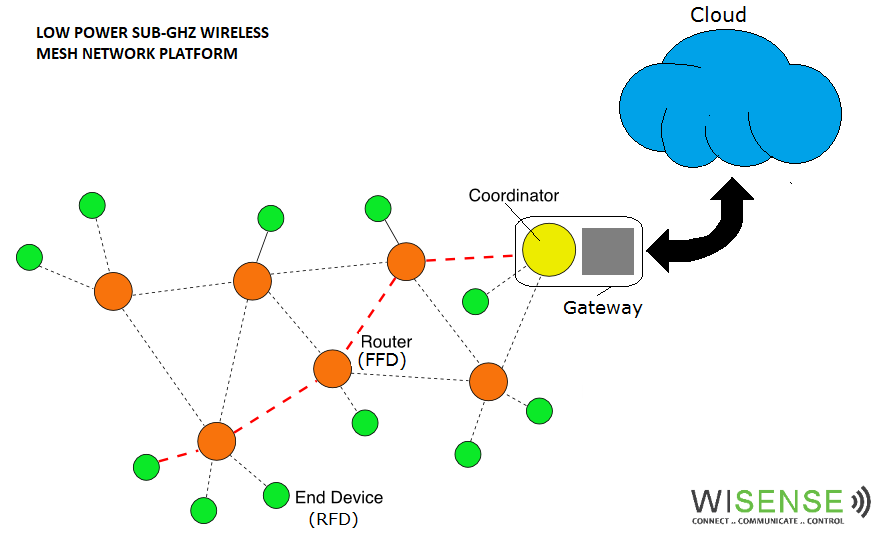

- Innovation in other tech like Blockchain & IoT

According to some members of the SIG, innovation in areas like blockchain and IoT among startups is yet to take off. These technologies can be hugely influential in navigating the curve of innovation in BFSI. A nudge in this direction could be beneficial for deeptech startups to enhance their working capabilities, and for banks & financial institutions as well who can lend their data and existing infrastructure to support the growth of such technologies. A right step in this direction would be initiate consortium dialogues.

Current Members of BFSI-SIG:

| Participant Member | Company Name | Designation |

| Deep Thomas | Aditya Birla Management Corporation | Group Chief Data and Analytics Officer |

| Manas Dasgupta | ANZ | Head of Wealth Technology India, ANZ || Chairperson of ICT &3i Committee, BCIC || Innovation Leader & Diversity Champion |

| Sandeep Varma | DBS Bank | Head of Innovation, India |

| Hari RAJAGOPALAN | HSBC | Senior Vice President – Sales | Global Liquidity & Cash Management |

| Ramya Padmanabhan | HSBC | Innovations Lead – Commercial Banking | Global Transformation Centers |

| Dr. Vadlamani Ravi | IDRBT | Head, Center of Excellence in Analytics |

| Venkat Kumar | Kotak Mahindra Bank | Vice President at Kotak Mahindra Bank, Inventor, Head of Innovation Labs & Fintech Collaborations |

| Manish Jain | KPMG India | Partner – Digital Consulting | Fintech | Digital Ledger | Transaction Banking | Innovation |

| Arun Mehta | Royal Bank of Scotland (RBS) | Head of Data & Analytics – Digital Engineering Services |

| Sonal Tivarekar | Swiss Re | Head Strategic Initiatives & ARC Bangalore | Sr. Vice President | Global Business Solutions |

| Ramakrishna Vempati | Thomson Reuters | Lead Innovation |

| Rajesh Gupta | Nasdaq (India) | MD |

| Suresh Iyer | Nomura Services India Pvt. Ltd | Executive Director, Head of Enterprise Data Management |

Related posts

What Lies Ahead For India’s High-Potential Clinical Trial Market?

Projecting revenues of $250K, Cardiotrack is transforming how primary healthcare functions

Avanijal’s app irrigates fields while helping farmers save water and sleep!

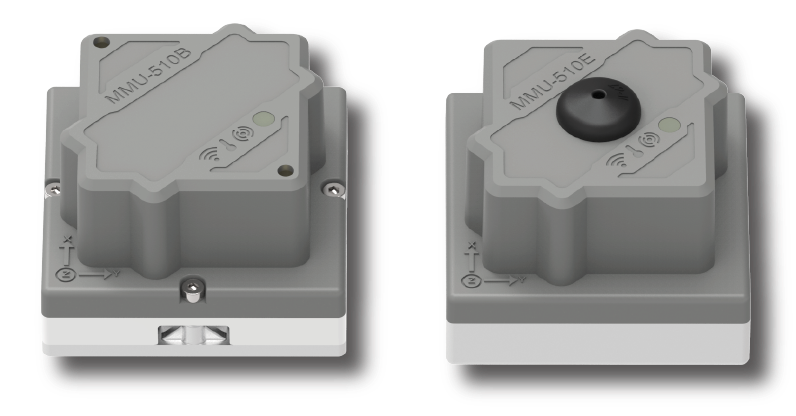

WiSense: engineering veterans provide a platform for Internet of Things ideas

GE Healthcare India Edison[TM] Accelerator: The first-ever global startup collaboration program!

CynLr: Making Manufacturing Simple with Visual Robots!

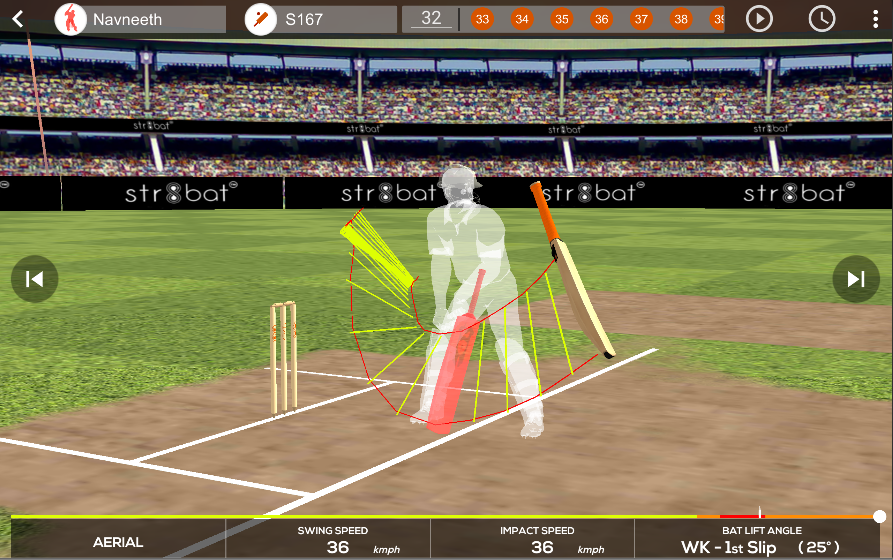

STR8BAT gives INSTANT, VISUAL and ACTIONABLE IN-SIGHTS, HELPING PLAYERS PLAY BETTER EVERYDAY

The Evolution of Bluetooth: From Entertainment To Smart Buildings

Qualcomm selects three startups for $100K design prize

When All Else Fails, This Internet Network Can Bail You Out Of A Crisis

Villgro funds agri start-up GRoboMac

Baby Steps Towards A Better Future

ENLITE: Unleashing Deep-tech Innovation to make buildings intelligent and smart!!

Asset downtime management with IIOT

Exclusive: Former Snapdeal exec Anand Chandrasekaran backs Uncanny Vision

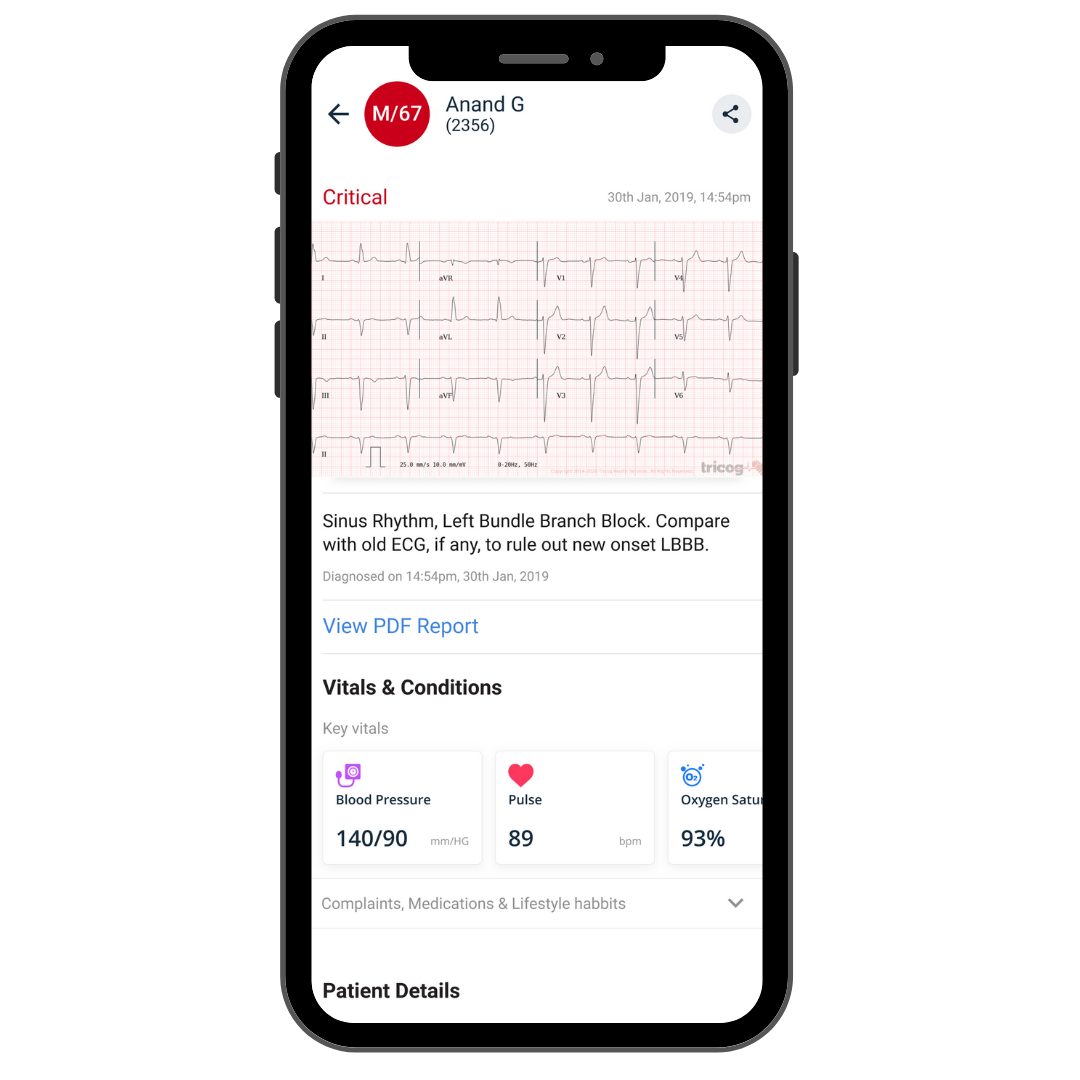

Portable ECG device helps save lives in rural areas, reduces cost for patients

Here Are 3 Startups From India You’ll Want To Watch In 2017

Driving Digital Awakening Across Enterprises Today

Data-driven insights for an improved game on the cricket field

Qualcomm to announce tech startup winners of $100,000 Design in India challenge today

Your Local APMC-Mandi Just Got Smarter

Universal Healthcare- Digital Propulsion 30th April 2019 at Shangri La’s Eros Hotel- Delhi

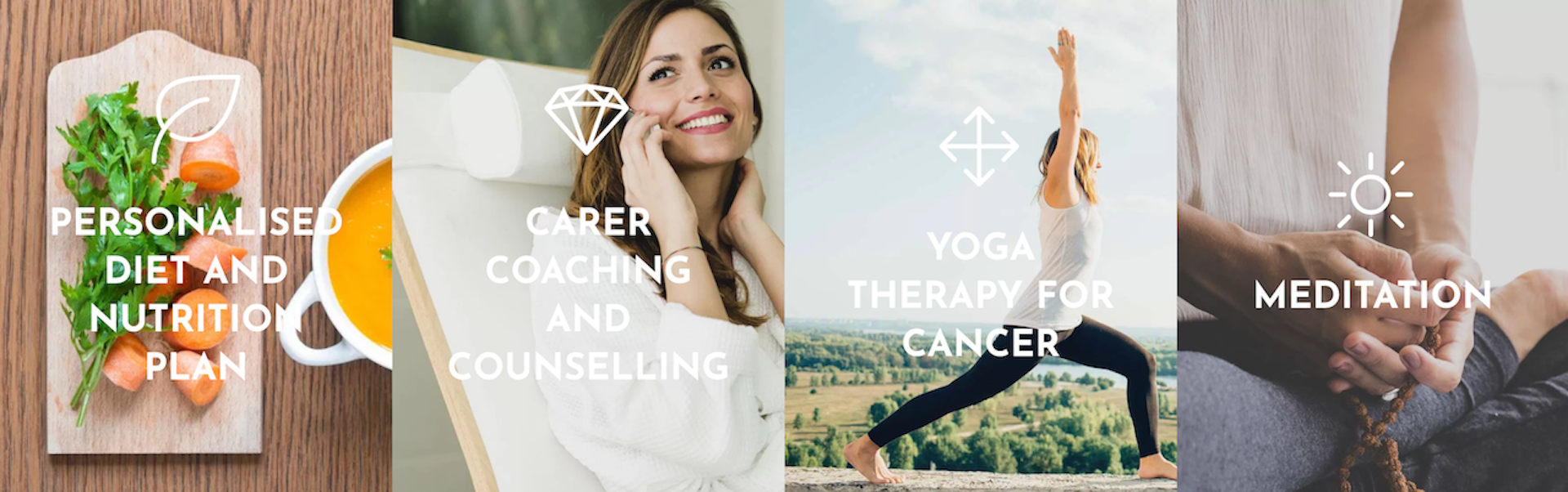

A Billion Dollar Market – India’s Health Insurance Market Is At A Precipice Of Change

Cardiotrack partners with Columbia Asia Hospitals to provide AI-based solutions in cardiac care

SeeHow Announces Smart Cricket Coaching System in Partnership with Rx Cricket Academy

Embedsense Solutions: Developing IoT based solutions to transform the manufacturing and transportation landscape!

TekUncorked LVIoT: A platform that aims to Light up Lives!!

Get Set, Co-Create: This Startup Is On The Fast Lane To Innovate With Mercedes’ Startup Autobahn

Transforming Sports Gear into Smart Devices to Deliver Real-Time Analytics

Oh Baby! Deep Technology Learns To Rock

Qualcomm Announces Top Eight Finalists for Cycle I of Qualcomm Design in India Challenge II

India is a thriving hub for AI; Skilled talent key to its growth

IoT industry should have common standards: Teaotia

This Bengaluru techie-turned-farmer has made India’s first agri-tech robot to battle farm labour shortage

Dozee: Enabling Seamless Remote & Contactless Patient Monitoring!

EzeRx: A step towards a Healthier tomorrow!

Vizara: On A Journey to Preserve & Present India’s Heritage and Culture using cutting-edge technologies!

Hardware startup Sensegiz catches fancy of KARSEMVEN, raises $500,000

IoT India Congress recognises top three IoT focussed thought leaders and Start-up in India

Last Mile Pandemic Response with AI

AiNDRA System: A Home to AI-based medical devices for detecting Cervical Cancer!

4 Bengaluru startups will work with Airbus to shape the future of aerospace

Dhruva Space: Innovation to power Space-based Full-Stack applications!

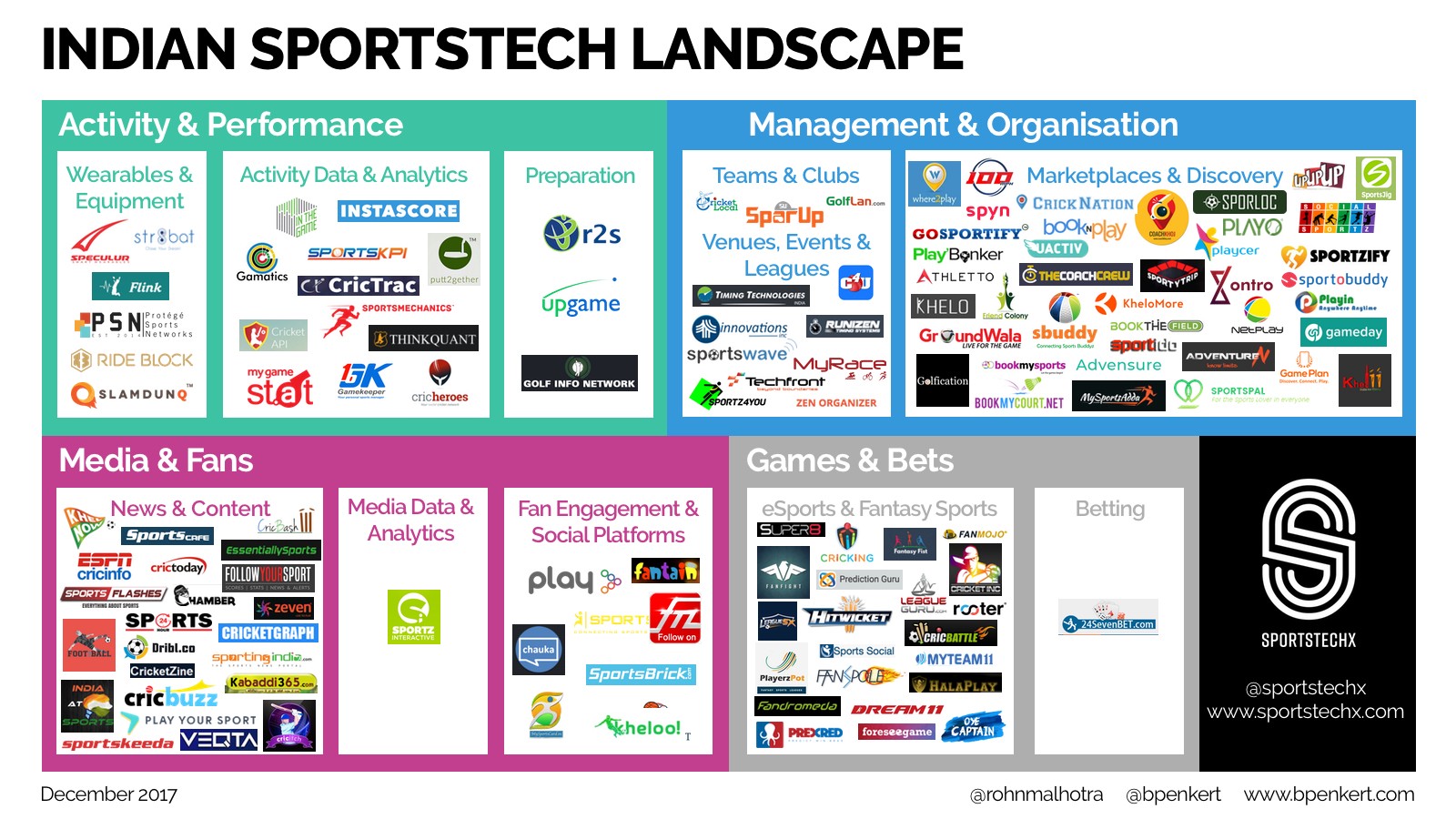

Overview of the Indian #sportstech landscape

Working In Hazardous Conditions? Worry not, IoT Comes To The Rescue

Cardiotrack collaborates with iMMi Life for cardiac care

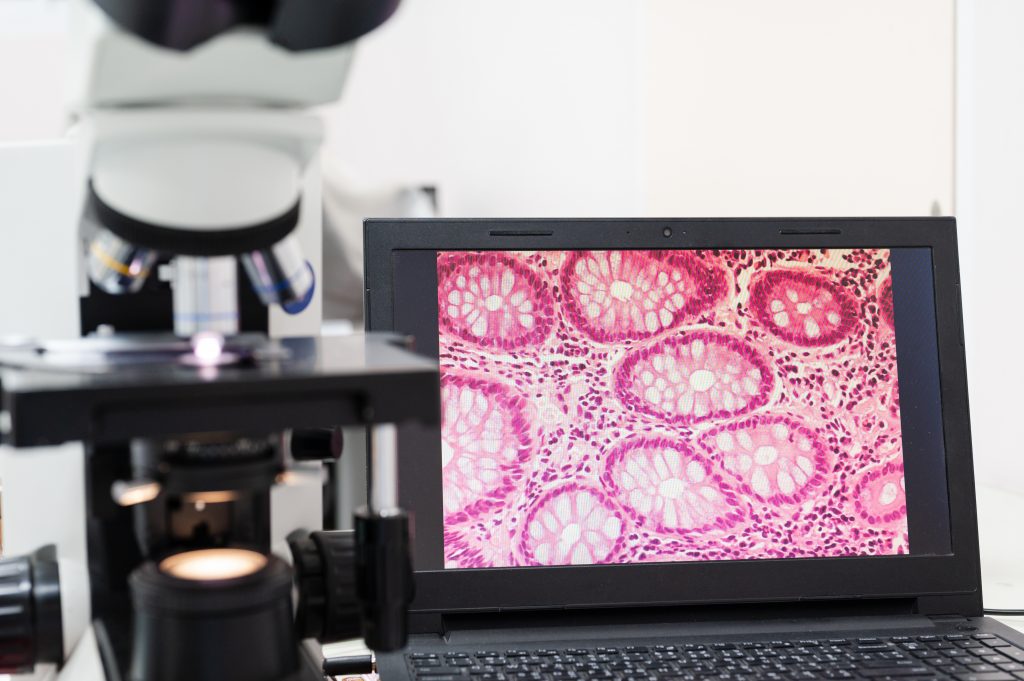

Qritive: Leveraging AI to enhance histopathology diagnosis of cancer & the quality of patient care!

Nestle picks up SilverPush and IotPot for its ‘next big project’

ICANN Principal Technologist Alain Durand discusses scope of research on Draft Durand Object Exchange

IoT Pot plans to take cooking Knob to US

Medtech takes centre stage at AIRmaker’s new batch of 8 IoT startups

SenseGiz-A vision to make the world appreciably productive, safer and secure place to live in!

LHIF Report Nov 2018

MedPrime Technologies: Developing customer-centric solutions to increase accessibility and affordability of healthcare facilities!

Reliance’s Unlimit, IBM collaborate to power IoT innovation in India

Nimble Vision: On a mission to use technological innovation to achieve environmental sustainability!

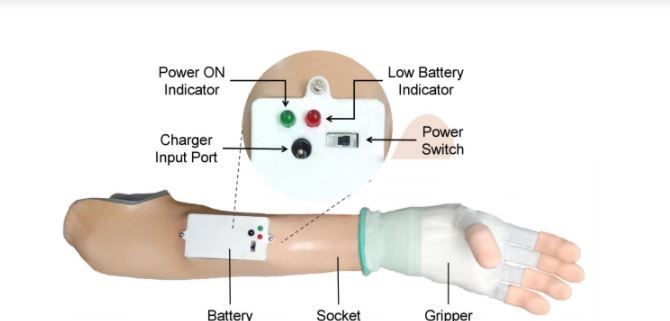

From Womb To Cloud: This Startup Is Monitoring Maternal Health Using Smart Wearables

Ossus Biorenewables: Addressing the need for a carbon-free source of heat in process industries!

Co Create 2nd Round Table Meeting

Say hello to #LHIF

OnwardAssIst: A cancer prognostics platform built to help clinicians and oncologists with tools to assist better cancer diagnosis and treatment!

This IoT startup plugs holes in your leaky bucket

D-NOME: Building Platform Technology to enhance molecular diagnostics!

How Industries & Innovators Can Leverage The Power of Digital Technology in Manufacturing

Here comes the Robot Reaper

Tricog Health: Health: Applies AI and medical expertise to enhance and empower cardiac care!

AI for an Eye Makes The World Better For The Visually Impaired

Nasscom Discussion

Latest News

Recent Posts

- From Industries to Public Services: AI Innovation Challenge Bridges Tech and Real-World Impact July 10, 2025

- The Future of Incubation: What the Next Generation of Startup Support Looks Like April 29, 2025

- The Impact of AI in Healthcare April 22, 2025

- The Evolution of AI & Industry 4.0 – What’s Next? March 26, 2025

- Disrupting Supply Chain Management: Meet Startups Driving Innovation March 17, 2025