More than just cricket

The Indian sports tech space is still in a very nascent stage but there have been significant strides made over the last 18–24 months. Properties such as the Indian Super League (Football) and Pro Kabaddi League can’t yet compete with the commercial clout of the Indian Premier League (Cricket), but their growing popularity and the increased interest in other alternative sports such as marathons, cycling and even eSports is indicative of a growing sports economy thus presents opportunities for startups. Initiatives such as the recently concluded Sports Analytics Conference in India and increased Investor buzz with a number of startups having raised funding in 2017 are positive signs indicating an industry that is on the brink of a strong growth spurt.

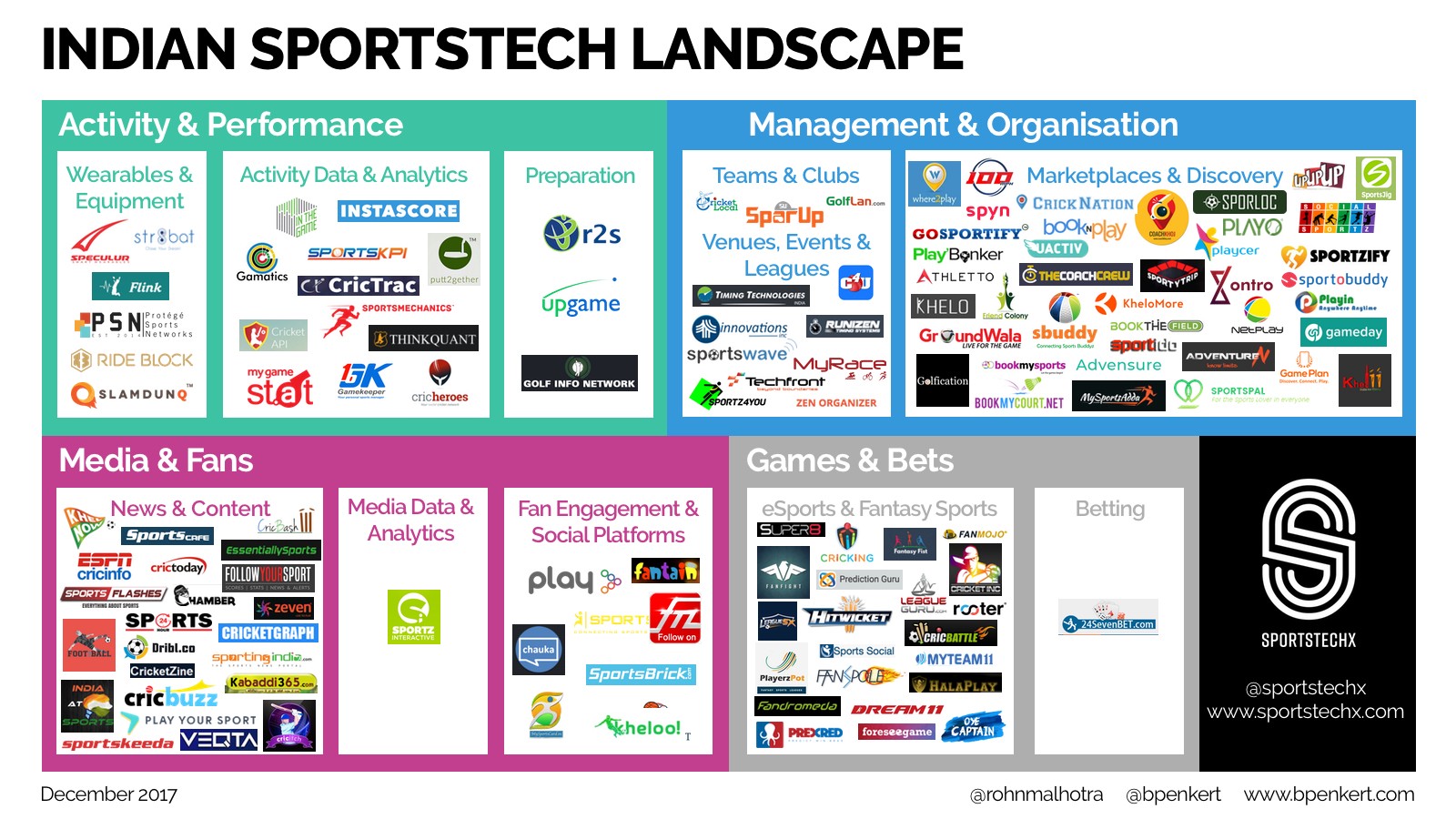

We’ve screened over 360 SportsTech companies in India, clustered them and put the most interesting ones into this overview. We also published overviews on other European SportsTech landscapes, now it’s time for India. Other countries and regions will follow

The four sectors of SportsTech

Here’s a brief description of how I divided the SportsTech landscape. Check this article for more details.

Activity & Performance: Solutions surrounding the actual performance, no matter if it’s before, during or after the activity. Typical offerings are data tracker, wearables and new kinds of sports equipment.

Management & Organisation: Solutions that help to manage organisations, venues, leagues and events. Also covers platforms to find other sportsmen, coaches, etc. and to buy products and services, such as tickets or trips.

Media & Fans: Solutions that provide sports interested people and companies with all kinds of content and data. Also includes social platforms that help with branding and connecting fans with athletes, teams, etc.

Games & Bets: Companies that provide eSports, Fantasy Sports and Betting solutions, for players & gamers and as a service.

Note: Some companies cover two or even more sectors/subsectors. For the purpose of this overview they had to be assigned to only one.

Here are a few Sports Tech companies emerging from India that we want to highlight.

Cricket API : API solution for Cricket and Kabaddi, provides real time data allowing publishers to display live scores, advertisements and create fantasy games with minimal tech fuss

Fantain: Mobile based fan engagement platform helping sports teams engage with fans through various channels, also provides analytics and activation solutions

Flink: Smart badminton sensor acting as a virtual coach and smart tracker providing personalized data for performance analysis

Golf LAN: Provides a suite of golf solutions including tee time booking, virtual caddies, golf cart management and analytics

HitWicket: World’s largest online cricket management game with strategic multiplayer gaming and an active online social community

Playo: India’s most widely used local sports and player discovery and arena booking platform

Rooter: Sports gaming platform promoting social network driven interactions during live games

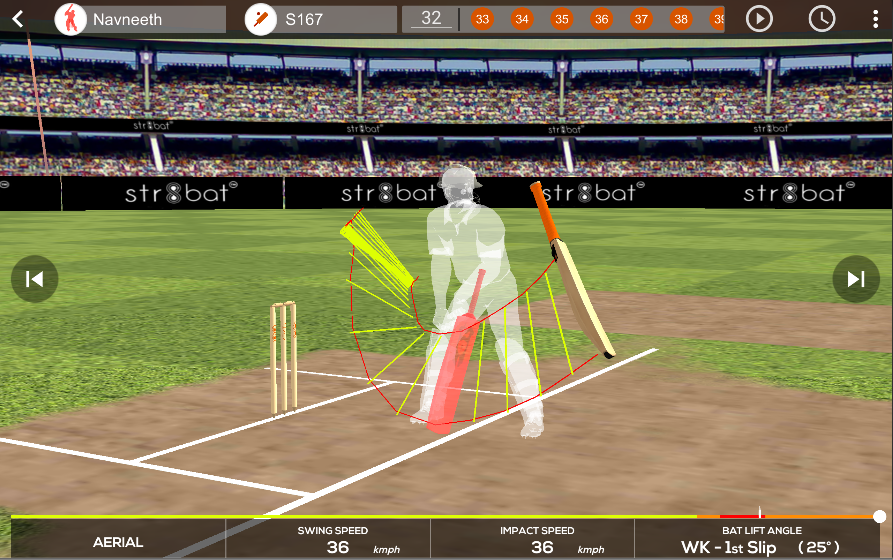

Str8bat: Developer of sensor based wearables for cricket, recently named one of the top 50 sports startups in the world by the Hype Foundation

Timing Technologies India: Provide a suite of timing related solutions for a variety of sports, primarily focussed on running

Veqta: On demand live streaming for sports content from across the globe, recently bagged the digital broadcasting rights for the Mayweather-McGregor fight

You think I’ve missed a company? Reach me via LinkedIn, Twitter or mail.

Distribution within the country

City distribution: As expected most of the companies are located in the National Capital Region, combining Delhi, Gurgaon and Noida. They are home for almost one quarter of the respective SportsTech market. Overall Bangalore is the city with the most companies, with Mumbai and Delhi following behind.

Sector distribution: The Indian SportsTech market has a clear focus on the “Management and Organisation” sector, especially with regards to classic marketplace solutions. It’s followed by “Media & Fans” with a strong “News & Content” subsector. Worth to mention is also a populated “eSports & Fantasy Sports” subsector, which is the third biggest overall.

Approx. 63,4% of the SportsTech companies in India have been founded since 2015, which is clearly more than the European average and shows an intense movement in the market.

Interested in more data & insights? Reach me via LinkedIn, Twitter or mail.

More data coming up

I’m constantly publishing insights from the international SportsTech ecosystem and also run a podcast. Make sure you follow me here on Medium and sign up to my newsletter.

This article was co-developed and written with Rohn Malhora. You can find about more about him and his activities on Twitter and his Medium channel. Thanks Rohn for the great collaboration!

<hr size=0 width=”100%” align=center>

Benjamin Penkert is the Founder of SportsTechX and Head of Consulting at the leAD Sports Accelerator in Berlin. You can get in touch via Linkedin, Twitter or email.

In case you’ve enjoyed this article please comment, recommend and share 🙂

Courtesy: SportsTechX

Related posts

From Womb To Cloud: This Startup Is Monitoring Maternal Health Using Smart Wearables

Baby Steps Towards A Better Future

What Lies Ahead For India’s High-Potential Clinical Trial Market?

Universal Healthcare- Digital Propulsion 30th April 2019 at Shangri La’s Eros Hotel- Delhi

A Billion Dollar Market – India’s Health Insurance Market Is At A Precipice Of Change

Cardiotrack collaborates with iMMi Life for cardiac care

BFSI – Strategy Innovation Group (BFSI-SIG)

Avanijal’s app irrigates fields while helping farmers save water and sleep!

Portable ECG device helps save lives in rural areas, reduces cost for patients

Nestle picks up SilverPush and IotPot for its ‘next big project’

Here Are 3 Startups From India You’ll Want To Watch In 2017

Qualcomm selects three startups for $100K design prize

4 Bengaluru startups will work with Airbus to shape the future of aerospace

Medtech takes centre stage at AIRmaker’s new batch of 8 IoT startups

Driving Digital Awakening Across Enterprises Today

GE Healthcare India Edison[TM] Accelerator: The first-ever global startup collaboration program!

Cardiotrack partners with Columbia Asia Hospitals to provide AI-based solutions in cardiac care

LHIF Report Nov 2018

Projecting revenues of $250K, Cardiotrack is transforming how primary healthcare functions

The Evolution of Bluetooth: From Entertainment To Smart Buildings

This IoT startup plugs holes in your leaky bucket

Oh Baby! Deep Technology Learns To Rock

IoT Pot plans to take cooking Knob to US

Working In Hazardous Conditions? Worry not, IoT Comes To The Rescue

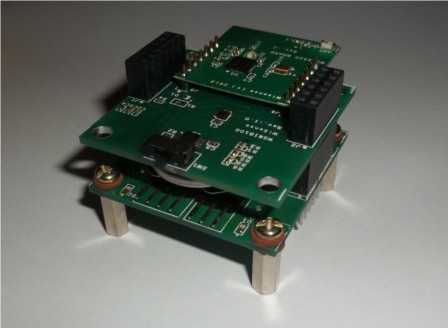

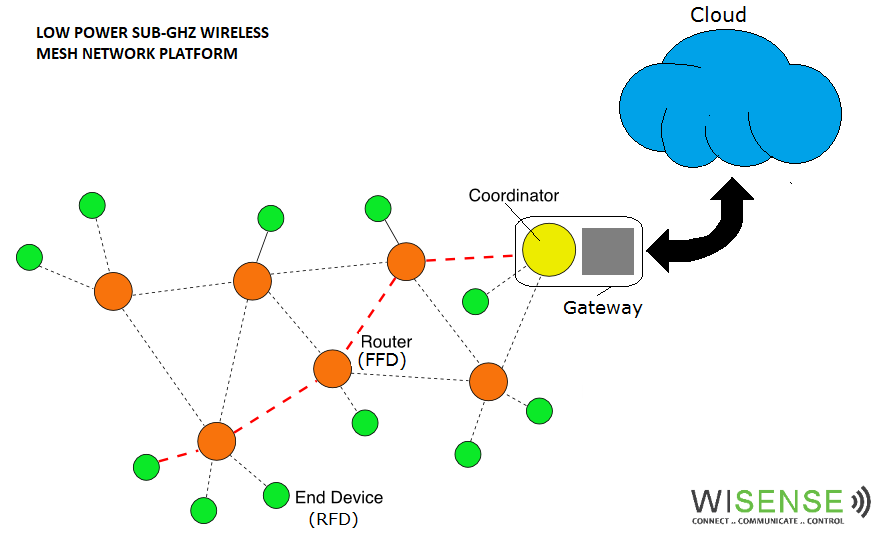

WiSense: engineering veterans provide a platform for Internet of Things ideas

Qualcomm to announce tech startup winners of $100,000 Design in India challenge today

SenseGiz-A vision to make the world appreciably productive, safer and secure place to live in!

Your Local APMC-Mandi Just Got Smarter

AI for an Eye Makes The World Better For The Visually Impaired

When All Else Fails, This Internet Network Can Bail You Out Of A Crisis

SeeHow Announces Smart Cricket Coaching System in Partnership with Rx Cricket Academy

Villgro funds agri start-up GRoboMac

This Bengaluru techie-turned-farmer has made India’s first agri-tech robot to battle farm labour shortage

Exclusive: Former Snapdeal exec Anand Chandrasekaran backs Uncanny Vision

Get Set, Co-Create: This Startup Is On The Fast Lane To Innovate With Mercedes’ Startup Autobahn

Transforming Sports Gear into Smart Devices to Deliver Real-Time Analytics

IoT India Congress recognises top three IoT focussed thought leaders and Start-up in India

Here comes the Robot Reaper

Qualcomm Announces Top Eight Finalists for Cycle I of Qualcomm Design in India Challenge II

Data-driven insights for an improved game on the cricket field

How Industries & Innovators Can Leverage The Power of Digital Technology in Manufacturing

Reliance’s Unlimit, IBM collaborate to power IoT innovation in India

IoT industry should have common standards: Teaotia

STR8BAT gives INSTANT, VISUAL and ACTIONABLE IN-SIGHTS, HELPING PLAYERS PLAY BETTER EVERYDAY

Hardware startup Sensegiz catches fancy of KARSEMVEN, raises $500,000

Say hello to #LHIF

Nasscom Discussion

Latest News

Recent Posts

- From Industries to Public Services: AI Innovation Challenge Bridges Tech and Real-World Impact July 10, 2025

- The Future of Incubation: What the Next Generation of Startup Support Looks Like April 29, 2025

- The Impact of AI in Healthcare April 22, 2025

- The Evolution of AI & Industry 4.0 – What’s Next? March 26, 2025

- Disrupting Supply Chain Management: Meet Startups Driving Innovation March 17, 2025