26th Feb 2019

Round Table

A Billion Dollar Market – India’s Health Insurance Market Is At A Precipice Of Change

Context

Health insurance is not a luxury but a necessity today. Given the propensity and range of diseases that man is prone to, having a healthcare premium is imperative. India has more than 60 insurance companies, of which nearly 40 are dedicated to health insurance.

There are a plethora of needs in the healthcare sector, which require insurance intervention. By 2021, health insurance is expected to reach US$3.5bn, representing growth of more than 12% annually since 2006. Moreover, the increase of non-communicable diseases (NCDs) in India such as diabetes, cardiac issues and cancers require cost-heavy intervention. A sound healthcare premium will go a long way in safeguarding citizens from skyrocketing costs.

Due to imminent changes in the eco-system, the sector is constantly in a state of flux. While Government spend is increasing with various schemes announced by Central and State Governments, the healthcare insurance market is challenged with process compliance, fraudulent practices, skewed claims ratio, low coverage, increased out-of-pocket expenses and policy support.

The healthcare insurance market is dynamic, offering myriad opportunities for innovators, investors, enterprises and policy makers. Yet, it is imperative to address existing challenges, identify high-opportunity areas and chart a roadmap for future success.

At the BioAsia Conference 2019 in Hyderabad, an industry roundtable led by NASSCOM Center Of Excellence IoT’s flagship healthcare initiative Lifesciences & Healthcare Innovation Forum (LHIF), where industry participants comprehensively discussed the opportunities & challenges around healthcare insurance market and role of technology and policy in easing the situation for the public.

Challenges

- Delays in claims processing is a major concern not only for the patients but also for the hospitals. Any extra day spent by the patient occupying a bed waiting for a discharge due to delays in insurance paperwork, may not result in higher returns to the hospitals.

- Health Insurance companies are not able to assess the risk exposure from their customers. Many of them do not disclose pre-existing ailments and no sooner they take health insurance, these customers start availing the claims. As the risk profile and historical medical records are not available for the insurers, they have no option but to offer same policy to all.

- Policy provisions are neither clear on the websites, nor do the customers read and understand the available terms and conditions. Many of them realize the inclusions and exclusions once they start using the claims process.

- Inflation in the healthcare delivery costs is steadily increasing the claims, however there is a challenge in increasing the insurance premiums. As the affordability of the premiums is reducing, it is difficult to acquire new customers. Increased competition and untenable provisions offered by some companies, is putting pressure on other companies in this space. Customers only see the cost of the premium without realizing the provisions within.

- There is no regulatory body, which controls the health insurance procedures at Hospitals. Some providers tend to overuse the facilities for the customers having health-insurance.

- Due to inadequate staff to monitor the enrolled hospitals and also due to some unscrupulous individuals, there is 15% incidence of abuse.

- 60-70% of the populations living in rural India. Many of them are illiterate to Health Insurance. They only know abouthealth cards issued by government and not sure the provisions there under.Despite large penetration of PM-JAY, the insurance companies are yet to see a viable financial model for them to succeed in enrolling into the Ayushman Bharat. The cost of the packages fixed by government may impede the quality of care.

- Though Ayushman Bharat equally emphasises on wellness, the Health Insurance companies do not see a possibility of participation in preventive health compared to curative health, mainly due to no incentives provided to them on preventive health.

- There is no clarity or clear guidance from either regulatory or the government on the same day procedures – Out-Patient Surgeries, that can be covered under health insurance. As a result, individuals prefer to get admitted for at least a day to claim the insurance. This increases the cost of the claim. Also, many individuals lack awareness on the same-day procedures. Though some hospitals are offering same day procedures, it is not clear if the insurance companies are accepting these claims.

- Smaller bills are cleared fast without necessarily checking for the potential frauds, whereas large bills need go through more diligence for validation and verification. This results in genuine customers switching the insurer due to dis-satisfaction.

- Non-payment of claims arises from three factors. (a) Lack of proper documentation, (b) Lack of awareness of inclusion and exclusion criteria in the policy and (c) difference in costs from the same hospitals for same procedures.

Opportunities

- A uniform platform for sharing health profile of individuals (similar to the credit profile) will really help Insurance Companies to customize the insurance products based on individuals. Those will better health profile tend to get lower premiums.

- Nearly 60% of the population do not have health insurance coverage, even 10% of them buying the health insurance policies, will dramatically increase the revenues for the Insurers and they may be able to provide better services.

- Government is increasing the focus on wellness and with the help of regulatory. We can see positive guidelines & directions in this space.

- Insurance companies provide health-check coupons to their customers, but only 7-8% of them are utilized. But a push in wellness from government and corporates can increase the utilization. More utilization of these coupons may result in better data for Insurance companies to customize their premiums.

- Hospitals and Health Insurance companies can work together to provide a better customer experience.

Role of Technology

- Technology can play a major role in prevention campaigns in local language (due to increased mobile penetration). Insurance companies are willing to push customized content through these campaigns on basic problems like nutrition, sanitation, stress and prevention measures.

- Technology can help Third Party Administrators (TPAs) with documentation process and the aggregate data on the ailments and the procedures. This helps in customizing the offerings and speeding up the claims process.

- A well implemented EHR/PMR Systems at Government and Private Hospitals can provide a lot of insights for both the insurers and hospitals. PMR data can help in understanding the customer well before offering a suitable insurance product.

- Integration of Hospital Billing systems to TPA claims processing system can ease out on the time for processing a claim. Technology can also help in discharge process automation within Hospital environment to reduce the time for discharging a patient.

- AI can play a significant role in fraud detection process and disease predictions.

- Affordable wearables can help monitor the customers data by the Insurers and their empanelled doctors and provide timely advise on preventive health.

- Insurance companies can work with telemedicine platform providers to engage with their customer to reduce the hospitalization through early interventions.

- There is an increased opportunity for Health Insurers to engage with Healthcare Startups.

- Managing NCDs is a biggest opportunity towards wellness and preventing potential complications arising out of NCDs. Use of technology in engaging with the customers on managing NCDs will help the Insurers in avoiding future hospitalization.

Better pricing, continuous engagement with the customer and preventive measuresto help the health insurance sector can boost the sector’s organic and robust growth.

Participants

| Ashish Gupta | Chief Executive Officer | DocPrime |

| Amit Chhabra | Head of Health Insurance | Policybazaar.com |

| Layak Singh | Founder & CEO | Artivatic Data Labs |

| G.Bharati | CEO | Family Health Plan Limited |

| Anurag Rastogi | Chief Actuary & Chief Underwriting Officer | HDFC Ergo |

| Dinesh Pillaipakkamnatt | Co-founder | Sine Flex Solutions |

| Rani SudhakarRanipeta | Senior Vice President & Branch Head | Global Insurance Brokers |

| Rajeev Chourey | Vice President – Quality & Operations | Care Hospitals |

| Dr.LilySaleem | Chief Operating Officer | The Deccan Hospital |

| Ms.Seema Gaur | Head – Telangana Corporate Office | United India Insurance |

| Yesudas | United India Insurance | |

| Raghuram Janapareddy | Director – Lifesciences & Healthcare | NASSCOM (Moderator) |

Related posts

Projecting revenues of $250K, Cardiotrack is transforming how primary healthcare functions

AI for an Eye Makes The World Better For The Visually Impaired

Cardiotrack partners with Columbia Asia Hospitals to provide AI-based solutions in cardiac care

4 Bengaluru startups will work with Airbus to shape the future of aerospace

IoT Pot plans to take cooking Knob to US

Here Are 3 Startups From India You’ll Want To Watch In 2017

The Evolution of Bluetooth: From Entertainment To Smart Buildings

Driving Digital Awakening Across Enterprises Today

Working In Hazardous Conditions? Worry not, IoT Comes To The Rescue

Baby Steps Towards A Better Future

This Bengaluru techie-turned-farmer has made India’s first agri-tech robot to battle farm labour shortage

Your Local APMC-Mandi Just Got Smarter

LHIF Report Nov 2018

Here comes the Robot Reaper

This IoT startup plugs holes in your leaky bucket

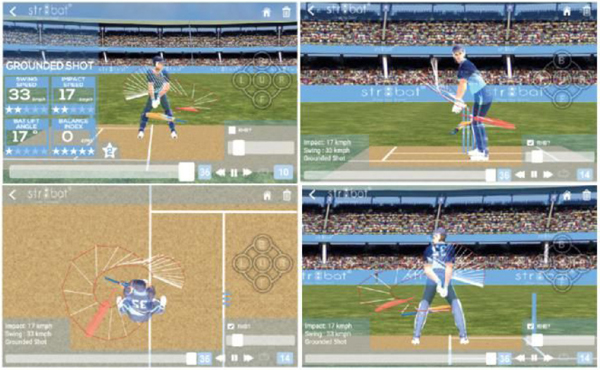

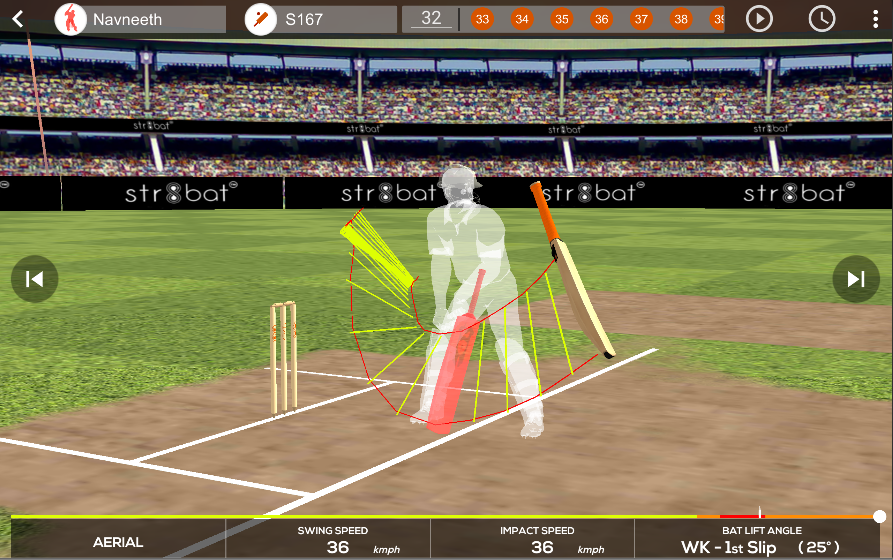

STR8BAT gives INSTANT, VISUAL and ACTIONABLE IN-SIGHTS, HELPING PLAYERS PLAY BETTER EVERYDAY

GE Healthcare India Edison[TM] Accelerator: The first-ever global startup collaboration program!

Villgro funds agri start-up GRoboMac

Qualcomm to announce tech startup winners of $100,000 Design in India challenge today

When All Else Fails, This Internet Network Can Bail You Out Of A Crisis

SenseGiz-A vision to make the world appreciably productive, safer and secure place to live in!

Medtech takes centre stage at AIRmaker’s new batch of 8 IoT startups

Nestle picks up SilverPush and IotPot for its ‘next big project’

Avanijal’s app irrigates fields while helping farmers save water and sleep!

Data-driven insights for an improved game on the cricket field

Hardware startup Sensegiz catches fancy of KARSEMVEN, raises $500,000

Qualcomm selects three startups for $100K design prize

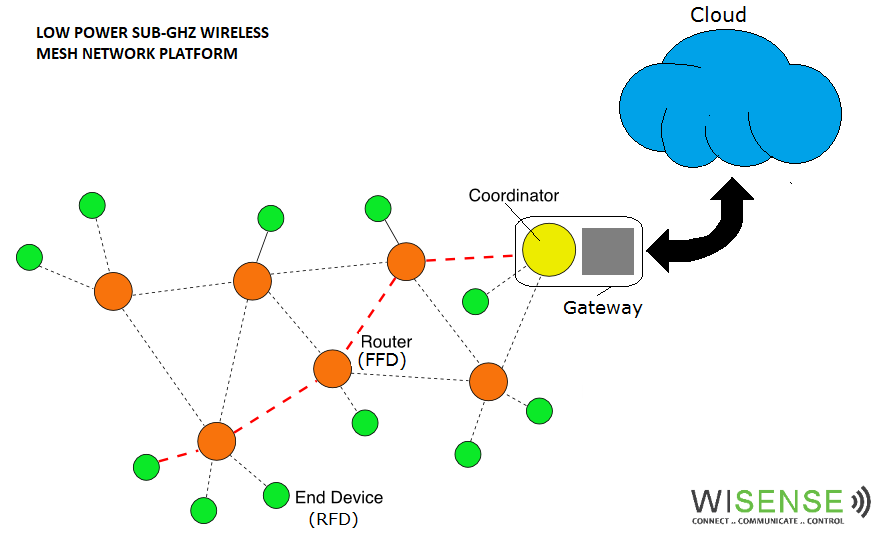

WiSense: engineering veterans provide a platform for Internet of Things ideas

How Industries & Innovators Can Leverage The Power of Digital Technology in Manufacturing

Oh Baby! Deep Technology Learns To Rock

Transforming Sports Gear into Smart Devices to Deliver Real-Time Analytics

IoT industry should have common standards: Teaotia

Get Set, Co-Create: This Startup Is On The Fast Lane To Innovate With Mercedes’ Startup Autobahn

Reliance’s Unlimit, IBM collaborate to power IoT innovation in India

IoT India Congress recognises top three IoT focussed thought leaders and Start-up in India

Portable ECG device helps save lives in rural areas, reduces cost for patients

Universal Healthcare- Digital Propulsion 30th April 2019 at Shangri La’s Eros Hotel- Delhi

Exclusive: Former Snapdeal exec Anand Chandrasekaran backs Uncanny Vision

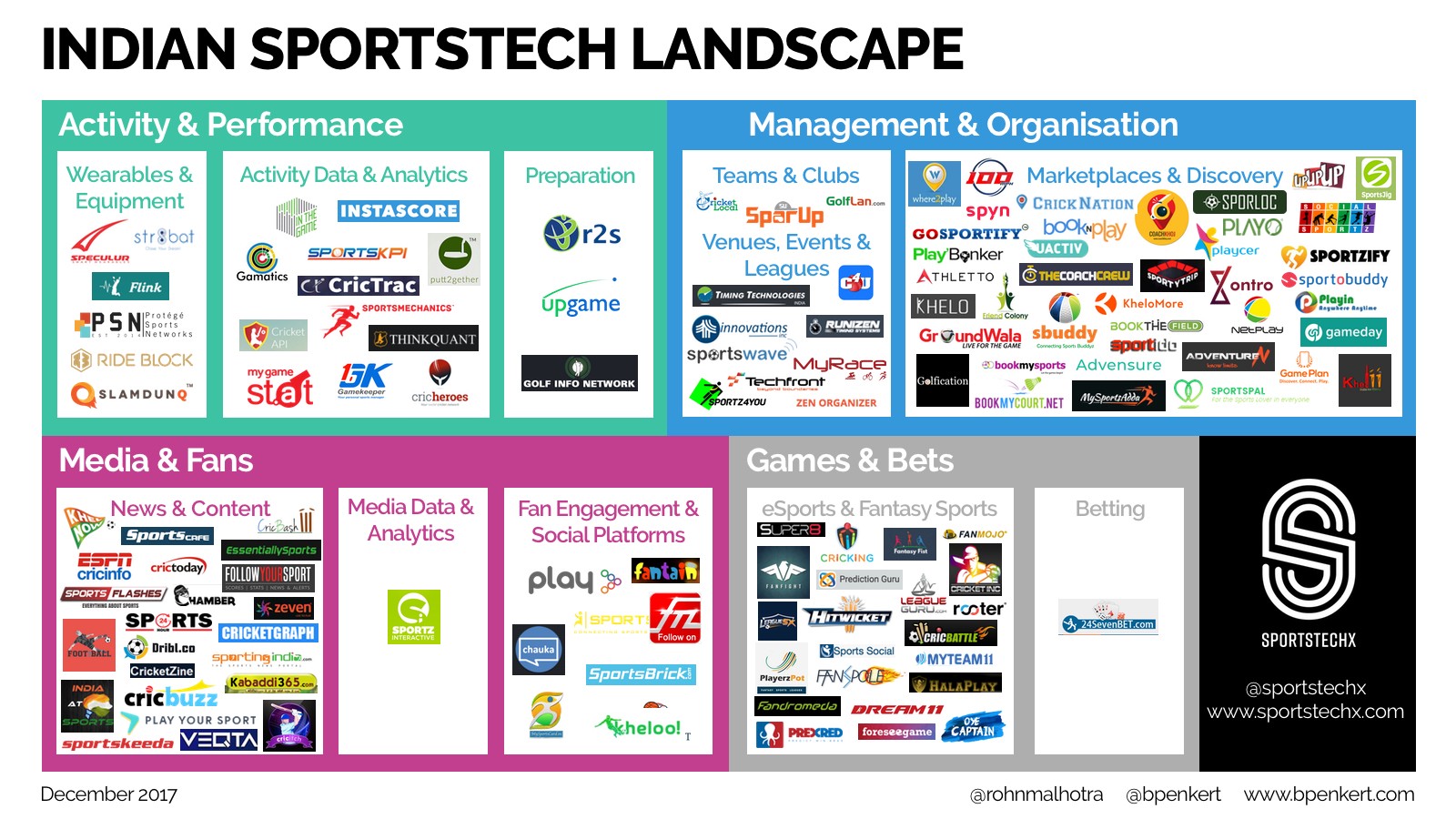

Overview of the Indian #sportstech landscape

BFSI – Strategy Innovation Group (BFSI-SIG)

Cardiotrack collaborates with iMMi Life for cardiac care

SeeHow Announces Smart Cricket Coaching System in Partnership with Rx Cricket Academy

From Womb To Cloud: This Startup Is Monitoring Maternal Health Using Smart Wearables

Say hello to #LHIF

What Lies Ahead For India’s High-Potential Clinical Trial Market?

Qualcomm Announces Top Eight Finalists for Cycle I of Qualcomm Design in India Challenge II

Nasscom Discussion

Latest News

Recent Posts

- XYMA Analytics: Builds Industry 4.0-enabled Ultrasonic Waveguide-Based Sensing Solutions To Help Industries Enhance Productivity And Efficiency!! May 12, 2023

- Botsync: Building Accessible Automation Solutions to Automate Intralogistics Operations! April 18, 2023

- IOTian technologies: Bringing the power of AI and IoT together for Breakthrough Innovation! February 27, 2023

- NeoDocs: Bringing Futuristic Diagnostics at the Fingertips!!! February 8, 2023

- Technology trends to look out for in 2023 January 16, 2023