The last 12 months has seen India’s startup ecosystem undergo major changes. Funding in general has been more regulated, with investors putting profitability ahead of profligacy.

Though the year didn’t see much big-ticket funding, more startups gained access to funds, with three sectors — Internet of Things (IoT), Fintech and Edutech – finding favor with investors.

Here are three Indian startups, one representative of each sector, that are doing great things and are worthy of your attention in the upcoming year.

1. FluxGen Engineering Technologies (IoT): Solving India’s Water Shortage Crisis

FluxGen, which began operations in 2011, has developed a low-cost and local IoT solution for energy and water management (EWM). In India, like many developing nations, both power and water are in short supply. FluxGen’s EWM system measures supplies at the consumer end electronically, providing alerts via web applications when levels drop due to excessive consumption or even just a leak.

At the supply side, EWM helps clients with tasks including the preventative maintenance of power plants or the continuous monitoring of overhead tanks and water pumps. FluxGen’s customers include Indian Railways, Robert Bosch and Titan.

In 2011, co-founder Ganesh Shankar quit his high paying job with U.S. giant GE to start FluxGen as a bootstrapped venture. “I had harbored the ambition to start a business on my own since my college years,” he said. “While working at GE, I constantly felt a lack of thrill that I had always wanted from my career. I also aspired to do something worthwhile that would benefit society. As all these thoughts accumulated, I took the plunge into entrepreneurship.”

Shankar said the company’s focus will be on B2B and B2G models for now. “Businesses and governments are more conscious about water conservation considering the scale and the associated losses incurred as a result of water shortages.”

2. Capital Float (FinTech): Ahead Of The Demonetization Curve

The Indian government’s recent demonetization move has given FinTech in the country a fresh boost. While Indians prefer to do most of their transactions in cash, the government is pushing to move to digital transactions to reduce corruption, giving FinTech firms a major fillip.

Capital Float is one such company generating a lot of interest not only among investors but within the FinTech community as well. Co-founders Gaurav Hinduja and Sashank Rishyasringa met at Stanford University in 2010. While in the U.S., they came across firms such as OnDeck and Lending Club, and concluded there was potential in India for similar online business and consumer lenders.

“In India there is a large population which is either unbanked or underserved by traditional financial institutions like banks,” said Hinduja. So they focused on the small and medium (SME) lending space. “Banks in India lend $150 billion to SMEs, whereas the demand is anywhere between $200-$400 billion,” added Rishyasringa.

But it wasn’t easy. They has a difficult time convincing potential investors, who questioned whether small business owners were digitally savvy enough to go through an online process.

“Even though it seemed counterintuitive at that time, we saw a huge opportunity,” said Rishyasringa. “When we first started, we decided to partner with the likes of Amazon and Snapdeal, an Indian e-commerce portal, and finance the vendors of these marketplaces.”

Today, Capital Float is India’s leading online platform providing working capital to SMEs, B2B firms and startups. They operate across 100-plus cities in India, and have so far raised $42 million in equity funding, making Capital Float the best-funded FinTech startup in India.

3. ToTSmart Education (EduTech): From The Student’s Perspective

It’s little wonder that a new generation of Indian startups is merging education with technology to come up with innovative solutions to make the school syllabus more relevant for students today. ToTSmart Education is one such startup working in this space. Founder Saurabh Arya says his company develops games and videos customized to meet an individual child’s learning requirements. The startup also publishes textbooks and is working with 600 schools across northern India.

ToTSmart Education came from an observation by Arya’s business partner — Prasad Ajinkya – when he enrolled his daughter in school and concluded that teachers often aren’t able to give children enough individual attention to assess learning style and needs. Personalization was key to a better education for India’s students.

The company hasn’t raised any funds yet as there hasn’t been a need for it — their business has grown 150% YOY with good accruals. Having spent a good nine years in the corporate world, both Arya and Ajinkya relied on their savings to launch and run business – but they’re planning on looking for investors in the coming year. “To address our working capital needs, we have raised debt funding from the Government of India,” said Arya. “As we are aggressive about our expansion plans in 2017, we will begin looking for funding during the early part of the year.”

Courtesy- Forbes

Related posts

Avanijal’s app irrigates fields while helping farmers save water and sleep!

4 Bengaluru startups will work with Airbus to shape the future of aerospace

LHIF Report Nov 2018

Projecting revenues of $250K, Cardiotrack is transforming how primary healthcare functions

Here comes the Robot Reaper

IoT industry should have common standards: Teaotia

Nestle picks up SilverPush and IotPot for its ‘next big project’

A Billion Dollar Market – India’s Health Insurance Market Is At A Precipice Of Change

Qualcomm to announce tech startup winners of $100,000 Design in India challenge today

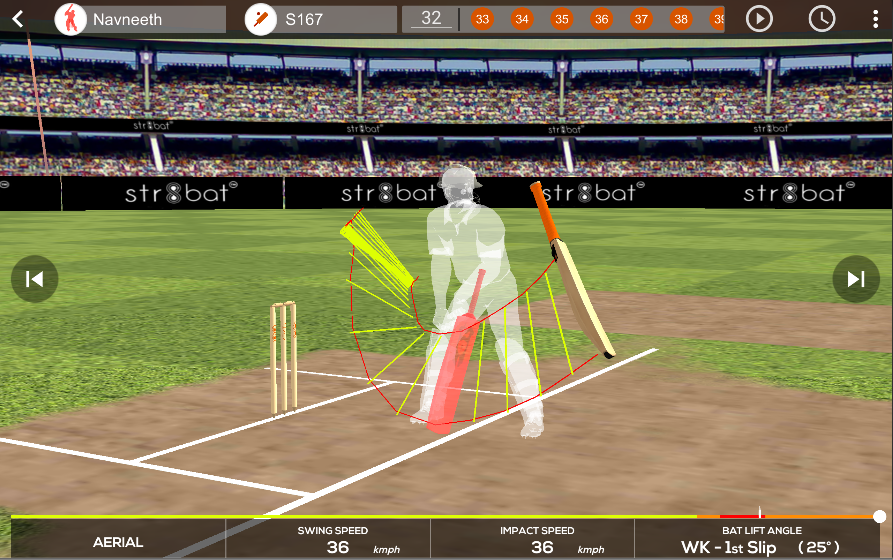

STR8BAT gives INSTANT, VISUAL and ACTIONABLE IN-SIGHTS, HELPING PLAYERS PLAY BETTER EVERYDAY

This IoT startup plugs holes in your leaky bucket

This Bengaluru techie-turned-farmer has made India’s first agri-tech robot to battle farm labour shortage

Say hello to #LHIF

The Evolution of Bluetooth: From Entertainment To Smart Buildings

From Womb To Cloud: This Startup Is Monitoring Maternal Health Using Smart Wearables

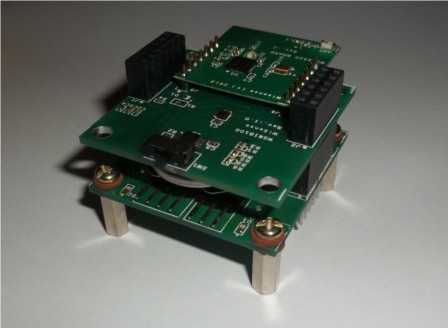

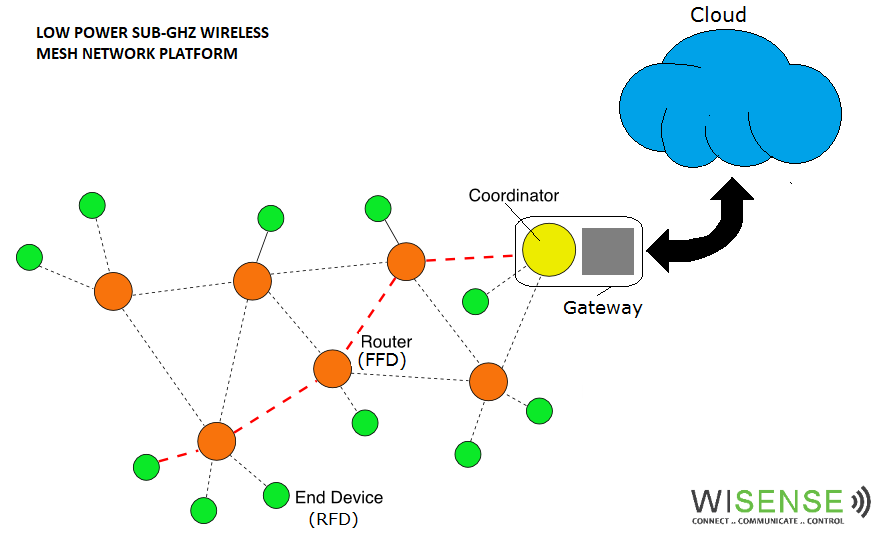

WiSense: engineering veterans provide a platform for Internet of Things ideas

Portable ECG device helps save lives in rural areas, reduces cost for patients

Medtech takes centre stage at AIRmaker’s new batch of 8 IoT startups

What Lies Ahead For India’s High-Potential Clinical Trial Market?

Cardiotrack partners with Columbia Asia Hospitals to provide AI-based solutions in cardiac care

Working In Hazardous Conditions? Worry not, IoT Comes To The Rescue

Cardiotrack collaborates with iMMi Life for cardiac care

SenseGiz-A vision to make the world appreciably productive, safer and secure place to live in!

Driving Digital Awakening Across Enterprises Today

Exclusive: Former Snapdeal exec Anand Chandrasekaran backs Uncanny Vision

GE Healthcare India Edison[TM] Accelerator: The first-ever global startup collaboration program!

Data-driven insights for an improved game on the cricket field

Qualcomm selects three startups for $100K design prize

Reliance’s Unlimit, IBM collaborate to power IoT innovation in India

Baby Steps Towards A Better Future

Oh Baby! Deep Technology Learns To Rock

Hardware startup Sensegiz catches fancy of KARSEMVEN, raises $500,000

Transforming Sports Gear into Smart Devices to Deliver Real-Time Analytics

BFSI – Strategy Innovation Group (BFSI-SIG)

When All Else Fails, This Internet Network Can Bail You Out Of A Crisis

Universal Healthcare- Digital Propulsion 30th April 2019 at Shangri La’s Eros Hotel- Delhi

IoT Pot plans to take cooking Knob to US

SeeHow Announces Smart Cricket Coaching System in Partnership with Rx Cricket Academy

Villgro funds agri start-up GRoboMac

Qualcomm Announces Top Eight Finalists for Cycle I of Qualcomm Design in India Challenge II

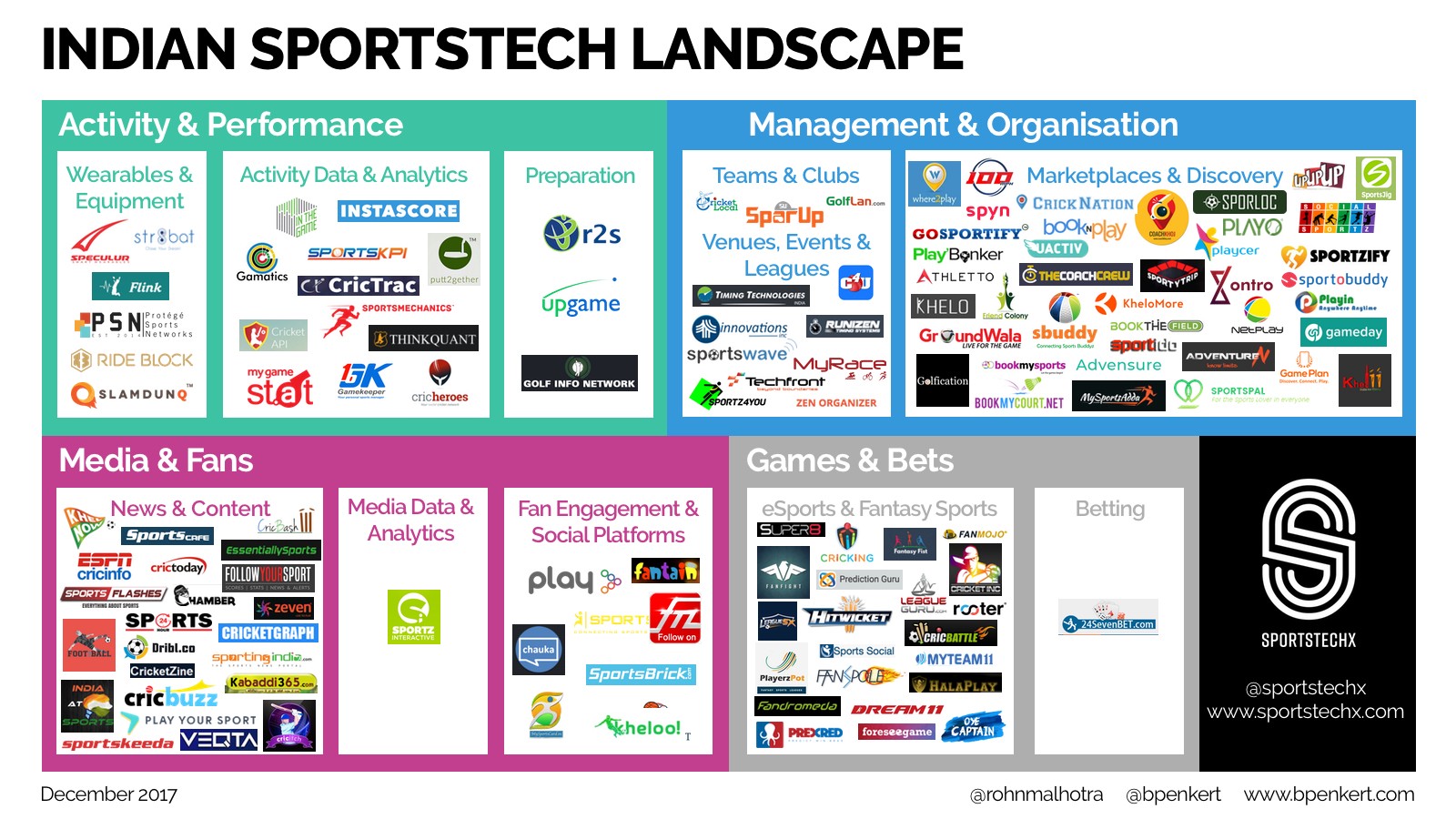

Overview of the Indian #sportstech landscape

AI for an Eye Makes The World Better For The Visually Impaired

How Industries & Innovators Can Leverage The Power of Digital Technology in Manufacturing

Your Local APMC-Mandi Just Got Smarter

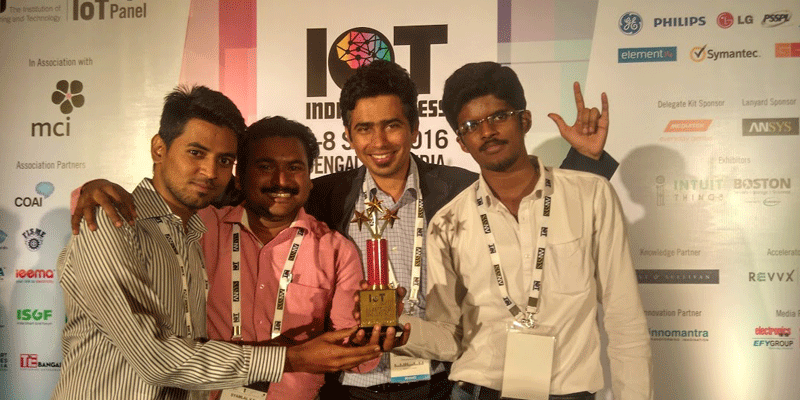

IoT India Congress recognises top three IoT focussed thought leaders and Start-up in India

Get Set, Co-Create: This Startup Is On The Fast Lane To Innovate With Mercedes’ Startup Autobahn

Nasscom Discussion

Latest News

Recent Posts

- From Industries to Public Services: AI Innovation Challenge Bridges Tech and Real-World Impact July 10, 2025

- The Future of Incubation: What the Next Generation of Startup Support Looks Like April 29, 2025

- The Impact of AI in Healthcare April 22, 2025

- The Evolution of AI & Industry 4.0 – What’s Next? March 26, 2025

- Disrupting Supply Chain Management: Meet Startups Driving Innovation March 17, 2025