As industries across India integrate artificial intelligence (AI) into their core operations, Gujarat is making steady progress in enabling this shift across both public and private sectors. Known for its deep-rooted manufacturing and enterprise networks, the state is now investing in the right mechanisms to support applied AI adoption: institutional frameworks, industry partnerships, and an ecosystem designed for co-creation.

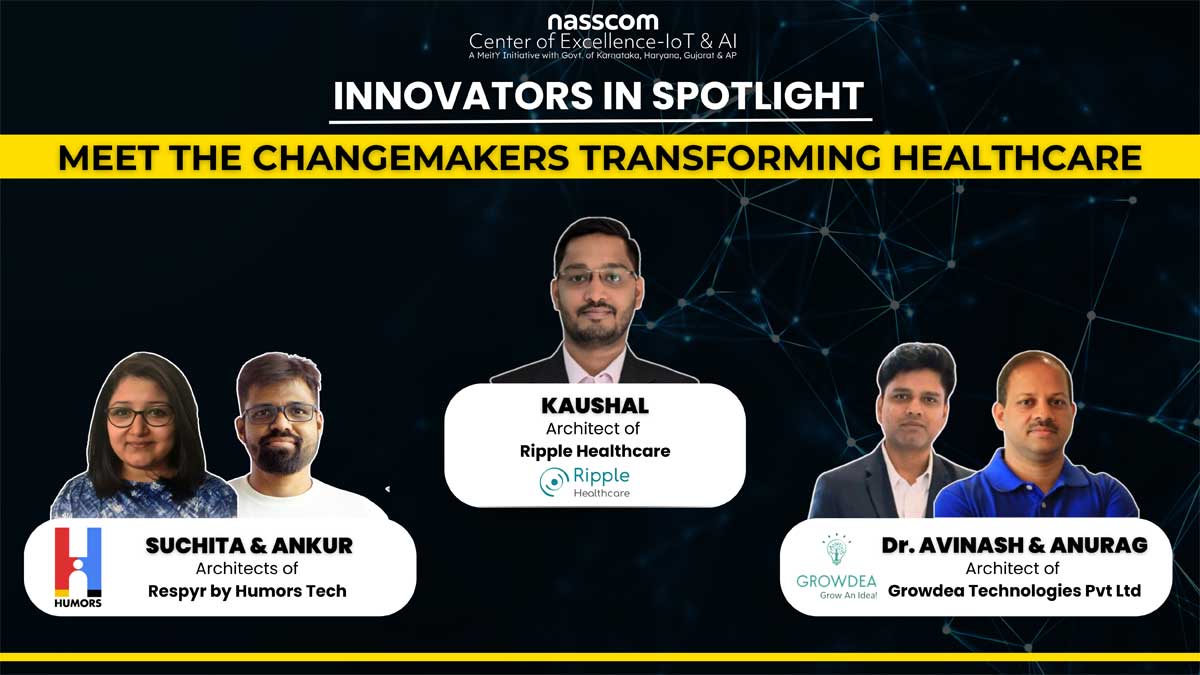

As part of this approach, the AI Centre of Excellence (AI CoE) was established by the Department of Science & Technology and Gujarat Informatics Limited, in support of Ministry of Electronics & IT (MeitY), and in collaboration with Nasscom and Microsoft. Inaugurated by Hon’ble Chief Minister Shri Bhupendra Patel with an aim to increase AI adoption in public & private sectors. He also launched the AI Innovation Challenge (AI-IC) as one of the flagship initiatives designed to accelerate meaningful AI implementation by bringing together problem owners and deep-tech innovators.